By RAY HENRY

The delays and cost overruns are piling up for a new plant in Georgia that was supposed to prove nuclear energy can be built affordably.

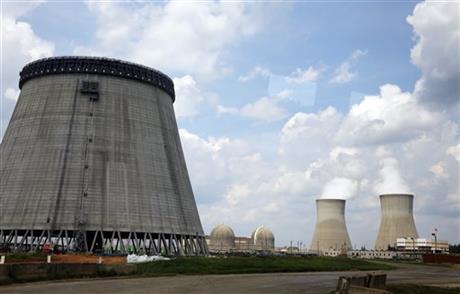

Instead, the companies building first-of-their-kind reactors at Plant Vogtle expect they will need an extra three years to finish construction. The plant’s owners and builders are fighting over who should pay for more than $1 billion in unexpected construction expenses — a figure that could easily grow.

Those eye-popping sums do not include the extra borrowing and inflation costs of the owners. At the end of the day, utility customers will end up paying most of the bill. A sister project in South Carolina owned by SCANA Corp. and Santee Cooper has run into similar delays and cost pressures.

Meanwhile, natural gas prices remain so low that regulators in Georgia say building a nuclear plant would not make financial sense if a utility was starting from scratch.

“When you start adding it all up, the numbers are getting very big,” said Sameer Rathod, an analyst at Macquarie Securities Group. “Who in their right mind would want to build a nuclear plant?”

The latest snag was disclosed Thursday, before Southern Co. announces its earnings next week. Southern Co. subsidiary Georgia Power said the nuclear plant’s designer and builder, Westinghouse Electric Co. and Chicago Bridge & Iron Co., expect the first new reactor in Georgia will be finished in mid-2019. The second is supposed to start operating in mid-2020.

Originally, the first reactor was supposed to be producing power in April 2016, followed by the second reactor a year later. The owners have not agreed to that new schedule, and they say it might be shortened.

Southern Co. stock closed Friday at $50.72, down roughly 4 percent since before the announcement.

The power company “had indicated that it was waiting for a new schedule, but we were still surprised at the extent of the incremental delay proposed,” Deutsche Bank analysts Jonathan Arnold and Caroline Bone said in a research note for their clients.

Georgia Power, which owns a 46 percent stake in the plant, originally anticipated spending $6.1 billion on its share. The latest delays would push that spending to $7.4 billion — though state regulators will decide whether the extra costs can be passed to customers.

“It was never a budget — it was a forecast,” said Joseph “Buzz” Miller, Southern Co.’s president of nuclear development.

Miller said finishing the nuclear plant remains a better economic deal than halting it and building a series of gas-fired plants instead. He said expanding Georgia’s nuclear power supply leaves the state less vulnerable if natural gas prices swing in the future. The utility can seek damages from the builder, though the exact amount remained unclear Friday.

Still, the escalation of costs may not stop here.

A major factory in Louisiana that was supposed to build prefabricated parts for the project repeatedly failed to meet quality standards and deadlines. Instead, the builder turned to new suppliers, but regulatory reports show even the new firms have experienced startup trouble.

In Georgia, the plant’s owners say a construction contract protects them from the lion’s share of construction costs during the delay period, meaning Chicago Bridge and Iron Co. would have to take a loss. CB&I officials did not return messages seeking comment. However, CB&I is a publicly traded company with shareholders who have no incentive to lose money, so more legal disputes are possible.

___