By ELENA BECATOROS

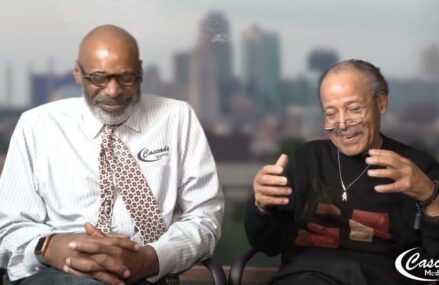

IMF’s troika representative to Greece Poul Thomsen, right, speaks as Greek Financial Minister Yannis Stournaras listens during a conference on the economy in central Athens, Monday, April 15, 2013. Greece cleared a key hurdle in its drive to receive its next batch of bailout loans after international debt inspectors said Monday they had reached an agreement over the country’s economic reforms, including the firing of some thousands of civil servants.(AP Photo/Petros Giannakouris)

ATHENS, Greece (AP) — Greece cleared an important hurdle in its drive to receive its next batch of bailout loans after international debt inspectors said Monday they had reached an agreement over the country’s economic reforms — including the firing of thousands of civil servants.

The review by delegates from the International Monetary Fund, European Commission and European Central Bank — known collectively as the troika — is part of a regular process under which Greece receives installments of its multibillion-euro bailout.

“Greece is being stabilized and our position is being bolstered,” Prime Minister Antonis Samaras said in a televised address Monday afternoon.

As well as reaching an agreement on the disbursement of 2.8 billion euros ($3.65 billion) worth of bailout loans pending from last month, Samaras said “the road has opened” for May’s installment of 6 billion euros.

Greece has been dependent on some 270 billion euros in bailout loans and other rescue packages since 2010, the lion’s share of which comes from Greece’s partners in the eurozone — the 17 European Union countries that use the euro. In return, successive Greek governments have pledged to overhaul the Greek economy and imposed stringent spending cuts and tax hikes.

Almost every troika review since the start of the bailout has been delayed due to targets being missed or disagreements with the government. Apart from the initial installments, no rescue loans have been disbursed on time.

Despite often major differences between the two sides, there was less tension for this review because the threat of imminent bankruptcy, which had hung over many previous negotiations, was no longer there.

The reforms have been painful for Greece. The country is mired in a deep recession, currently in its sixth year, and unemployment has spiraled to around 27 percent.

In a joint statement, the three institutions said recent steps taken by Greece will mean that targets for March “are likely to be met in the near future” and that the country’s debt sustainability “remains on track.”

The eurozone and IMF board are expected to approve the review in May.

The review mainly covered the dismissal of civil servants. The government and troika have been wrangling for weeks over state-sector job losses, something which hasn’t happened during the crisis so far despite pressure from Greece’s creditors and massive private-sector unemployment.

The firings would be “targeted at disciplinary cases and cases of demonstrated incapacity, absenteeism, and poor performance, or that result from closure or mergers of government entities,” the troika review said.

Samaras said 15,000 civil servants would be removed by the end of 2014, with 4,000 of them by the end of this year. New young employees will be hired in their place.

The job losses would include sacking those who have been convicted of criminal offenses or disciplinary violations, voluntary departures and from positions that have been axed.

“That is not a human sacrifice, as some claim. Firing people who have disciplinary violations and hiring young and able people. It is a qualitative upgrading of the public sector and a demand of the Greek people,” Samaras said.

Until now, civil servants have been constitutionally guaranteed jobs for life under a law dating from the early 20th century to protect public sector workers from unfair dismissal due to political affiliations. But the law was widely abused, with politicians accused of stacking the civil service in return for votes.

The result was a massively bloated, inefficient civil service with about 700,000 employees in this country of less than 11 million people — a total that was only discovered when a public sector census was carried out at the start of the bailout in 2010.

“It’s still a taboo to dismiss people from the public sector. There have been no forced dismissals of employees whose positions are eliminated or who for some reason do not perform,” the IMF’s troika representative Poul Thomsen said during a conference on the economy in central Athens.

“So this dramatic rebalancing of the economy … has caused a sharp increase in unemployment in the private sector while public sector employees have been protected. This is another source of the sense of lack of fairness in the process.”

Greece’s civil servants’ union, ADEDY, called a demonstration for Wednesday, saying the government was taking advantage of “unacceptable cases of violations and corruption” to cast blame on and make targets of all public sector workers.

Minister for Administrative Reform Antonis Manitakis said Greece’s creditors had long been pressing for 15,000 public sector workers to be sacked without being replaced, but the agreement to hire new workers in their stead followed the higher-than-anticipated number of retirements — more than 180,000 of which are expected between 2010-2015.

The troika also warned that the government must still be vigilant and “respond promptly to any slippages that may emerge.”

“Greece has indeed come a very long way,” said Thomsen. “The fiscal adjustment in Greece has been exceptional by any standard.”

If the country continues implementing reforms, no new austerity measures will be needed to achieve overall budget targets, Thomsen said.

The institutions still predict Greece will return to growth gradually in 2014.

Finance Minister Yannis Stournaras said Greece’s main target for this year was to achieve a primary surplus of the budget — a surplus without taking into account interest payments on existing loans.

Once this is achieved, Athens could request activation of something Greece’s eurozone partners agreed on late last year — a further reduction in the country’s private debt.

In March 2012, Greece forced private investors to write off more than half the value of the government bonds they held. Due to that, Greece’s debt is now mainly in public hands. A further debt reduction could come from easing the terms of the country’s bailout.

“The major target now is to achieve a primary budgetary surplus this year so that we can … ask for a drastic reduction in the public debt,” Stournaras said. “That will create a very positive boost in developments and would speed up our exit from the crisis.”

____

Nicholas Paphitis in Athens contributed.