BY MATT CAMPBELL

The Kansas City Star

The Kansas City Art Institute’s determination to collect a pledged but unfulfilled donation of money has pushed former banker Larry Dodge into bankruptcy, the Dodge family says.

Now, the school’s lawyers are focusing their efforts on making his wife, Kristina Dodge, pay a $3.3 million court judgment against the couple for failing to live up to their promise to donate money for a structure that was built on campus and bears their name.

The Kansas City Star first reported in November about the unfulfilled pledge and the litigation. Officials with the Art Institute said then they expected the Dodges to live up to their contract.

The law firm hired by the school recently filed a court motion to compel Kristina Dodge to produce documents about the couple’s financial situation. The firm also asked the court to make her pay the $10,000 bill for preparing that motion.

The lawyers say they need the documents to know whether Dodge is trying to avoid paying the judgment. They want to see her passport, “which may shed light on her true financial situation as well as any assets she may have abroad.”

At a hearing last week, the attorneys moved to force Dodge to turn over $10,000 in cash she said she was saving in her home for emergencies.

“They obviously think I’m hiding millions of dollars,” Kristina Dodge said. “That’s the only reason I can think of why they are being so vicious.”

In a new statement, the school said its board believed it was necessary to take action to collect the pledge in order to uphold the school’s fiduciary responsibilities as a college and a nonprofit organization.

“In fact, nonprofit organizations are required by the Financial Accounting and Standards Board to report pledges on their accounting statements as a way to show all assets and resources,” the statement said. “Failing to act to collect on pledges could show a deficit in accounting that might affect future contributions.”

The Dodges, who contend they were victims of the recession and of overly aggressive federal regulators who seized Larry Dodge’s bank, say they don’t have $3.3 million. According to the bankruptcy filing, they together receive about $4,000 a month in Social Security payments. That is less than a third of their reported monthly expenses, which include day care and school tuition.

The couple paid Larry Dodge’s bankruptcy lawyer with a transparent, acrylic plastic grand piano by Schimmel that had been a birthday gift from Larry Dodge to his wife.

The Dodges’ oceanside mansion in southern California is getting emptier as they put their possessions up for auction on eBay. Kristina Dodge said the only reason that she, her husband and their four daughters are still in the house is that no one bid for it on the courthouse steps after foreclosure. The house is upside down, with an appraisal less than is owed on it.

For now, Kristina Dodge says she is trying to keep her family healthy and happy.

Another challenge is that the woman who gave birth as a surrogate mother to the Dodges’ 2-year-old triplets now claims the contract was invalid and wants parental rights, according to a report in The Orange County Register.

“That’s what she’s saying, but I suspect it is money,” Kristina Dodge told The Star.

The surrogate’s attorney did not return a message seeking comment.

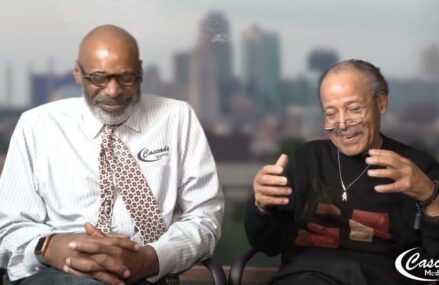

The Dodges were featured in December on the TV newsmagazine “Inside Edition.” In that report, Larry Dodge said he was once worth nearly $1 billion.

His American Sterling Corp. was umbrella to a bank by the same name in Sugar Creek, an insurance company and other interests. He and Kristina Dodge showered donations on cultural institutions.

In 2005, they agreed to donate $5 million in installments to the Art Institute to help the school construct a new building. The school received $1 million, and the Dodges’ names are prominently displayed on the side of the $7 million building at 4446 Oak St.

But the Dodges’ world of wealth and largesse crumbled. The bank was seized by federal regulators in 2009, and in 2011 the California Insurance Commissioner took action against the insurance company.

The Art Institute still wanted the money that had been promised it. The school sued and last year won a judgment in Orange County Superior Court.

Larry Dodge, acting as his own attorney, filed for Chapter 11 bankruptcy protection in December, but the case was dismissed because he failed to provide the proper paperwork. He then hired an attorney and refiled the request in February.

That meant the Art Institute had to get in line with Dodge’s other creditors. His obligations include a $1 million penalty to the Comptroller of the Currency related to the bank failure.

The bankruptcy filing estimates Dodge’s real and personal property at $1.6 million and his liabilities at $24 million.

Other unpaid pledges included $3 million to the Segerstrom Center for the Arts in Costa Mesa, Calif.; $2 million to the Redlands, Calif., school district; $1 million to St. Margaret’s Episcopal School in San Juan Capistrano, Calif.; and $275,000 to the University of California at Irvine.

Apparently, the Kansas City Art Institute is the only one to take the Dodges to court for not paying up.

Kristina Dodge said the Art Institute’s insistence in pursuing the matter could also force her into bankruptcy, something she hopes to avoid.

“If we have to get a place to live or a car, I would have to sign for it on my credit,” she said. “Without my credit, I don’t know where we would be. That’s the whole reason I don’t want to have to file bankruptcy.”

Read more here: http://www.kansascity.com/2013/04/18/4190426/kc-art-institute-lawsuit-forces.html#storylink_mainstorystack#storylink=cpy