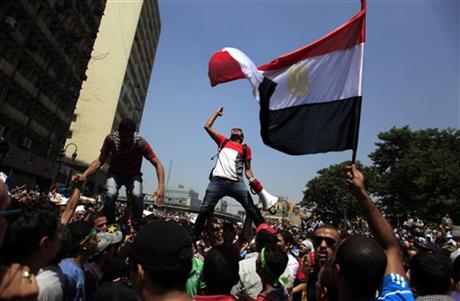

Supporters of Egypt’s ousted President Mohammed Morsi chant slogans during a protest in Ramses Square in downtown Cairo, Egypt, Friday, Aug. 16, 2013. Heavy gunfire rang out Friday throughout Cairo as tens of thousands of Muslim Brotherhood supporters clashed with vigilante residents in the fiercest street battles to engulf the capital since the country’s Arab Spring uprising. Tens of people were killed in the fighting nationwide, including police officers. (AP Photo/Khalil Hamra)

Mideast Egypt

A supporter of Egypt’s ousted President Mohammed Morsi chants slogans against Egyptian Defense Minister Gen. Abdel-Fattah el-Sissi before clashes broke out with Egyptian security forces in Ramses Square, downtown Cairo, Egypt, Friday, Aug. 16, 2013. Heavy gunfire rang out Friday throughout Cairo as tens of thousands of Muslim Brotherhood supporters clashed with security forces and armed vigilantes in the fiercest street battles to engulf the capital since the country’s Arab Spring uprising. At least 37 people were killed in the fighting nationwide, including police officers. (AP Photo/Hassan Ammar)

Prev

1 of 2

Next

The price of oil fell below $107 a barrel Monday as traders pondered the effects of the Egyptian crisis on transport costs and whether the U.S. Federal Reserve will start to reduce its monetary stimulus next month.

By early afternoon in Europe, benchmark oil for September delivery was down 62 cents to $106.84 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose 13 cents to close at $107.46 on Friday, which was its sixth straight day of gains, attributed to the continuing violence in Egypt.

The country has been wracked by ongoing clashes between supporters of ousted President Mohammed Morsi and the military-backed government. Nearly 900 people have died in the violence so far.

Egypt is not a major oil exporter, but there is concern that an escalation in fighting could spread to neighboring countries or disrupt the Suez Canal, a major trade route.

“It is extremely unlikely that the riots will cause any disruption to oil shipments through the Suez Canal and the neighboring Sumed pipeline, two transport routes which together transport up to 4.5 million barrels of crude oil and oil products per day,” analysts at Commerzbank in Frankfurt said in a report. “Nonetheless, the risk that the unrest might hamper transport does justify a risk premium on the oil price.”

Carl Larry of Oil Outlooks and Opinions said that while he doesn’t believe the Suez will close, “this means nothing to the companies that are going to increase insurance for shipping through the Canal. That in turn increases the costs and that eventually gets passed on to your friendly neighborhood oil consumer.”

Oil prices rose early Monday in Asia but then dropped, in tune with global stock markets. Many investors are reluctant to make a major move until the Fed clearly signals its intentions. It is widely held that the Fed will begin to reduce its $85 billion a month in asset purchases as early as September.

The Fed’s stimulus policy has lowered interest rates and made oil and other commodities a more attractive investment by offering potentially higher returns.

Brent crude, which is used to price imported crude used by many U.S. refineries, was up 3 cents to $110.43 a barrel for October delivery on the ICE Futures exchange in London.

In other energy futures trading:

— Heating oil was up 0.45 cent to $3.0949 per gallon.

— Wholesale gasoline added 0.96 cent to $2.856 a gallon.

— Natural gas rose 7.5 cents to $3.443 per 1,000 cubic feet.